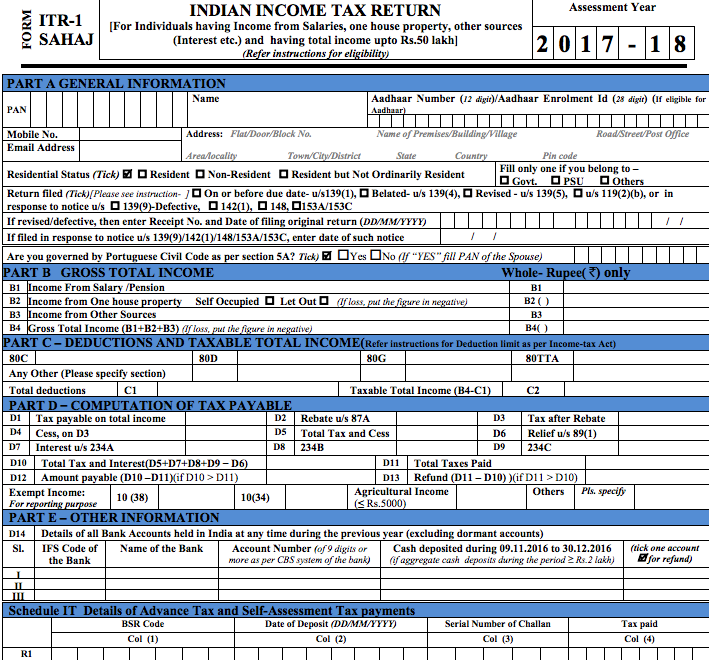

However, if you have secured capital gains or own more than one property in India, you will not be eligible to file ITR-1.

Hence, ITR-1 is the return filed by most salaried professionals in India. ITR-1 must be filled out by residents whose total income is not more than ₹50 lakhs. Lear more about Income tax returns online An Overview on ITR-1 If you need help determining which ITR form you need to file, get in touch with our tax specialists without further ado.

While filing your income tax returns, choosing the right form is crucial, as if you submit the wrong form your filing will be reflected under the defective list, which implies that re-filing is necessary. Therefore, people who have a job and fall within the taxable bracket have to ensure they are paying their taxes on time. Failure to comply with the rules and regulations mentioned in this act can lead to hefty penalties being levied on the offender. The Indian Income Tax Act, 1961 is an important piece of legislature that lays down all the rules regarding the payment of income tax in India. Here’s a look at everything you need to know about ITR-1 and how to file it. Filing of the ITR-1 form, otherwise known as SAHAJ, is a must for most salaried individuals in India.

0 kommentar(er)

0 kommentar(er)